Interest

Pronunciation: /ˈɪn.trɪst/ ExplainInterest is an amount paid based on the principal of a loan for the use of the money. When one borrows money, one is expected to pay it back to the lender, adding on interest.

The amount of money borrowed is called principal. If one borrows $100, the principal is $100.

The interest rate is the portion of the principle that is added as interest. For example, if the interest rate is 10% and the loan amount is £140, the interest amount is £14 (£140·0.10 = £14). Interest rates are typically given as an nominal interest rate per year.

If the interest is compounded more than

once a year, the actual interest rate is more than the nominal interest

rate. This rate is called the annual interest rate.

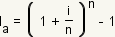

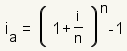

To convert a nominal interest rate to an annual interest rate, use the formula

where

ia is the annualized

interest rate, i is the nominal interest rate, and

n is the number of times per year the interest is compounded.

The part of the equation

where

ia is the annualized

interest rate, i is the nominal interest rate, and

n is the number of times per year the interest is compounded.

The part of the equation  is called the

accumulation factor. The accumulation factor

is a measure of how fast the principle grows. The greater the accumulation

factor, the faster the principle grows.

is called the

accumulation factor. The accumulation factor

is a measure of how fast the principle grows. The greater the accumulation

factor, the faster the principle grows.

The interest on first mortgages on homes usually runs from about 5% to 18%. Interest on credit cards can run from 10% to 36%. Interest on payday loans and title loans often runs as high as 1500%.

Variables

The variables that are used for calculation of interest in this article are:

| Variable | Description |

|---|---|

| I | Interest |

| r | Rate of interest |

| P0 | Initial principal |

| t | Number of periods elapsed (time) |

| Table 1: Descriptions of variables | |

Simple Interest

In simple interest, the interest is not added into the principal each period, but tracked separately. The formula for simple interest for a single period is I = P0·r. The formula for simple interest for multiple periods is I = (P0·r)·t. Typically, interest is rounded to the nearest two decimal digits.

Example 1: What is the interest on a loan of

£120 at a rate of 7%?

I = P0·r, P0 = £120, r = 7%

I = £120·0.07 (7% = 0.07. See

Percent.)

I = £8.40

Example 2: What is the interest on $1,423.67 at a rate of 8.7%?

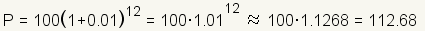

Compound interest is interest calculated using both

principal

and accrued interest. Table 1 show the compounding of interest on $100 at

1% per month.

The simplest equation for compound interest is

Another equation used with compound interest is

In order to make interest rates comparable, interest rates can be

annualized. The formula for annualizing

interest rates is Click on the blue point on the slider in manipulative 1 to

change the interest rate. Continuous compounding assumes interest is

compounded continuously. This can be calculated using the equation

I = P0·r, P0 = $1,423.67, r = 8.7%

I = $1,423.67·.087 = $123.85929

I = 123.86

(Round

to two decimal places.)

Compound Interest

Month Starting

PrincipalInterest Ending

Principal1 100.00 1.00 101.00 2 101.00 1.01 102.01 3 102.01 1.02 103.03 4 103.03 1.03 104.06 5 104.06 1.04 105.10 6 105.10 1.05 106.15 7 106.15 1.06 107.21 8 107.21 1.07 108.28 9 108.28 1.08 109.36 10 109.36 1.09 110.45 11 110.45 1.10 111.55 12 111.55 1.12 112.67 Table 2 - Compound interest  where

P0 is the initial principal,

i is the interest rate per period, and n is the number of

periods. Plugging the example from table 1 into the equation gives

where

P0 is the initial principal,

i is the interest rate per period, and n is the number of

periods. Plugging the example from table 1 into the equation gives

.

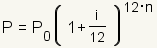

This equation is used if the interest is given as an annual interest, but compounds

monthly. Most home mortgages in the United States use this interest formula.

.

This equation is used if the interest is given as an annual interest, but compounds

monthly. Most home mortgages in the United States use this interest formula. ,

where ia is the annualized interest rate, i is the

interest rate and n is the number of times per year interest is compounded.

,

where ia is the annualized interest rate, i is the

interest rate and n is the number of times per year interest is compounded.Graphs of Compound Interest

Click on the blue points on the sliders to change the figure.

Manipulative 1 - Compound Interest Created with GeoGebra.

Discovery

Continuous Compounding

Click on the blue point in the slider and drag it to change the figure.

Manipulative 2 - Continuous Compounding Created with GeoGebra.

.

In this equation A represents the accumulated principal and interest,

P represents the initial principal,

e

is Euler's number, i represents the interest rate, and t

represents the time in years. The graph in manipulative 2 shows continuous

compounding. Click on the slider labeled i and drag it to

change the interest rate.

.

In this equation A represents the accumulated principal and interest,

P represents the initial principal,

e

is Euler's number, i represents the interest rate, and t

represents the time in years. The graph in manipulative 2 shows continuous

compounding. Click on the slider labeled i and drag it to

change the interest rate.References

Cite this article as:

McAdams, David E. Interest. 3/22/2019. All Math Words Encyclopedia. Life is a Story Problem LLC. http://www.allmathwords.org/en/i/interest.html.

Image Credits

Revision History

3/22/2019: Corrected wording. (McAdams, David E.)

12/21/2018: Reviewed and corrected IPA pronunication. (McAdams, David E.)

8/6/2018: Removed broken links, updated license, implemented new markup, implemented new Geogebra protocol. (McAdams, David E.)

6/13/2010: Added accumulation factor. (McAdams, David E.)

5/21/2010: Rewrote first few paragraphs for clarification. (McAdams, David E.)

2/18/2010: Rewrote article and included article 'Compound Interest'. (McAdams, David E.)

11/29/2008: Initial version. (McAdams, David E.)

- Navigation

- Home

- Contents

-

# A B C D E F G H I J K L M N O P Q R S T U V W X Y Z - Teacher Aids

- Classroom Demos

- How To

- LIASP

- LIASP Home

- Conditions of Use

- Privacy Policy

- Donate to LIASP

- Help build this site

- About LIASP

- Contact LIASP

All Math Words Encyclopedia is a service of

Life is a Story Problem LLC.

Copyright © 2018 Life is a Story Problem LLC. All rights reserved.

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License